Intel & NVIDIA – Combat for Turf

The battle between Intel and NVIDIA seems to have been locked in new combat for turf which is the booming data centre market and the core of this conflict is the technology which is changing the world- Artificial Intelligence. – AI. The revenue of NVIDIA in the recent quarter ended April 30, had augmented by 48% touching $1.94 billion in comparison to earlier year.

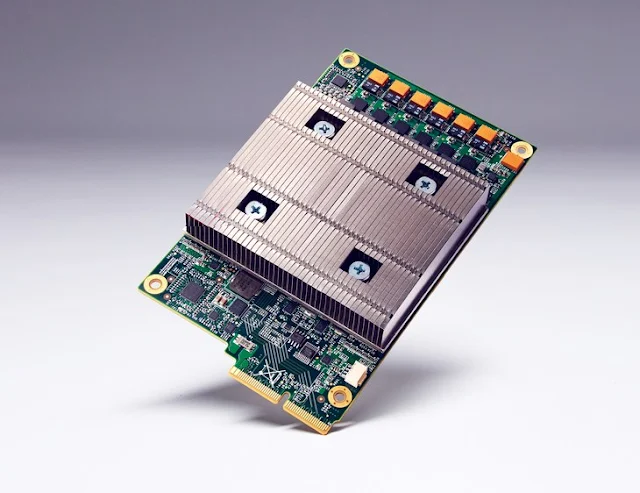

They had received a big revenue crash from its Data centre business that had recorded $409 million revenue in the first quarter of this fiscal, 186% up, year-on-year, due to the exponential increase in the spike in demand for specific type of microprocessor known as Graphic Processing Unit – GPU, prepared by NVIDIA. Most of the huge technology companies such as Amazon, Google, Microsoft, Facebook, IBM as well as Alibaba have installed the best Tesla GPUs of NVIDIA to control their data centres to perform machine learning in analysing data collected from the cloud and gain awareness.

The MD of NVIDIA, Vishal Dhupar, had commented that they had seen the PC era that had been followed by the mobile era and now envisage the emergence of the AI era. Once viewed only as a gaming technology, GPU are now making inroads in data centres driving initiatives around machine learning- ML together with artificial intelligence – AI.

Data centres are said to be storehouses of huge volumes of data that tends to connect the compute power of GPUs in order to make sense of huge repository of data. The arrival of GPUs have assisted in redefining the concept of systems designs for several of the high-performance application in the commercial and the non-commercial sectors of the market, according to Rajnish Arora, VP of enterprise Computing Research, IDC. Could it mean that Intel would be losing market share in the data centre space?

Arora had stated that they do not believe that Intel in losing share of the server CPU market to NVIDIA. The numbers evidently determine that Intelseemed to have consolidated its presence and market share in the server market. Presently Intel CPUs power data centres all across the globe and tends to revel in near control accounting for 95.7% of the entire server shipped in 2016.Moreover it is also betting big on AI and has financed greatly in start-ups that have assisted in building AI together with High-Performance Computing –HPC competences in its upcoming chips

Intel had bought Altera in 2015, for $16.7 billion, which was a company making programmable devices that could be optimised for AI and ML. It had gone ahead in August and had bought deep learning start-up Nervana Systems to strengthen AI specific solutions. The new chips called `Knights Mill’ will be sold later this year by Intel to address the growing Machine Learning – ML, market.

Moreover it is also working on `Knights Crest’ chips that will manage deep neural networks which is a component of deep learning – DL.A fellow at Intel Labs, Pradeep Dubey had stated that `competition has always been around and they are optimizing their chips for machine learning as well as deep learning applications since this is a big opportunity for them. There are also four new processors which will be released this year’. These products would be competing against NVIDIA GPU in the data centre market.

They had received a big revenue crash from its Data centre business that had recorded $409 million revenue in the first quarter of this fiscal, 186% up, year-on-year, due to the exponential increase in the spike in demand for specific type of microprocessor known as Graphic Processing Unit – GPU, prepared by NVIDIA. Most of the huge technology companies such as Amazon, Google, Microsoft, Facebook, IBM as well as Alibaba have installed the best Tesla GPUs of NVIDIA to control their data centres to perform machine learning in analysing data collected from the cloud and gain awareness.

The MD of NVIDIA, Vishal Dhupar, had commented that they had seen the PC era that had been followed by the mobile era and now envisage the emergence of the AI era. Once viewed only as a gaming technology, GPU are now making inroads in data centres driving initiatives around machine learning- ML together with artificial intelligence – AI.

Data Centres – Storehouses of Huge Volumes of Data

Data centres are said to be storehouses of huge volumes of data that tends to connect the compute power of GPUs in order to make sense of huge repository of data. The arrival of GPUs have assisted in redefining the concept of systems designs for several of the high-performance application in the commercial and the non-commercial sectors of the market, according to Rajnish Arora, VP of enterprise Computing Research, IDC. Could it mean that Intel would be losing market share in the data centre space?

Arora had stated that they do not believe that Intel in losing share of the server CPU market to NVIDIA. The numbers evidently determine that Intelseemed to have consolidated its presence and market share in the server market. Presently Intel CPUs power data centres all across the globe and tends to revel in near control accounting for 95.7% of the entire server shipped in 2016.Moreover it is also betting big on AI and has financed greatly in start-ups that have assisted in building AI together with High-Performance Computing –HPC competences in its upcoming chips

Knights Mill/Knights Crest

Intel had bought Altera in 2015, for $16.7 billion, which was a company making programmable devices that could be optimised for AI and ML. It had gone ahead in August and had bought deep learning start-up Nervana Systems to strengthen AI specific solutions. The new chips called `Knights Mill’ will be sold later this year by Intel to address the growing Machine Learning – ML, market.

Moreover it is also working on `Knights Crest’ chips that will manage deep neural networks which is a component of deep learning – DL.A fellow at Intel Labs, Pradeep Dubey had stated that `competition has always been around and they are optimizing their chips for machine learning as well as deep learning applications since this is a big opportunity for them. There are also four new processors which will be released this year’. These products would be competing against NVIDIA GPU in the data centre market.